News

Smartphone app from FICO, eDriving to score driving behavior

Appeared in San Francisco Chronicle November 27, 2016

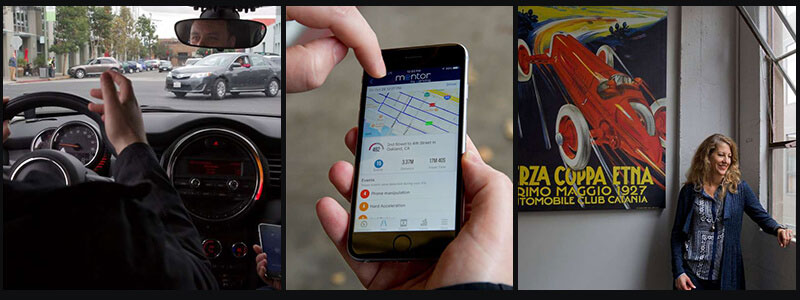

Two Bay Area companies — FICO and eDriving — next month will introduce a smartphone app that gathers information about your driving behavior and turns it into a score similar to FICO’s famous credit scores.

The FICO Safe Driving Score could be used by employers to monitor workers who drive on the job, by parents to assess their teen drivers and by couples to prove once and for all which spouse is the better driver.

Eventually, the two companies hope that insurers will use it to help set premiums, in states that allow it. Some insurance companies already offer pricing plans based in part on how, when and where customers drive.

Customers who opt for these plans usually plug a small device or dongle into the on-board diagnostics port located under the driver’s-side dashboard in most cars. The device transmits data from the car, such as miles driven and rates of acceleration and braking, to the insurance company. More recently, insurers have begun collecting information with smartphone apps. The growing use of telematics in what the industry calls “usage-based pricing” raises a host of privacy, fairness and transparency concerns.

In California, auto insurers can use a “technological device” only to collect information on miles driven, which is one of the mandatory factors that must weigh most heavily in pricing, or to locate an auto for emergency road, theft, travel or map service.

As a result, most companies don’t offer usage-based insurance in California. One exception is Metromile, a San Francisco company that sells pay-per-mile insurance. Also, Californians can buy driving apps and dongles for personal use from companies such as Zubie and Automatic, which also sell their technology to insurance companies.

EDriving, based in Oakland, says it’s different from other telematics companies because it’s more focused on improving driver behavior, and it now has access to FICO’s expertise.

FICO of San Jose provides not only credit scores but also FICO Insurance Scores, which give property and casualty underwriters an “instant assessment” of a customer’s risk based on information in the credit report. (California is among three states that do not allow the use of credit data in auto insurance.)

EDriving’s core business is providing driver’s education to beginning drivers, employees who drive a company car and people going to traffic school after getting a ticket. “We are the largest provider of fleet driver safety programs,” said Celia Stokes, eDriving’s CEO.

Its new product, called Mentor, is an app for Apple and Android phones. It uses the devices’ gyroscope and GPS system to capture route information and data that can be used to detect risky behaviors such as speeding, hard braking, rapid acceleration and using the phone while driving.

FICO uses that data to create a driving score ranging from 300 to the mid-800s. That’s the same general range as FICO’s credit scores, said Sally Taylor-Shoff, FICO’s vice president of scores. “It’s important for people to understand we are not using credit data” in the driving score. “We are using the telematics data. The focus is on the driver taking charge, improving their driving.”

Drivers who use Mentor will get a score for each trip and a composite score that rates their driving over time. The more trips they take, the better the composite score will become at predicting that person’s risk.

Users will also get, for each trip, a rating of good, average or poor for habits such as braking, accelerating, speeding, cornering and distraction, so they can see where they need to improve. They can click on an event such as a hard stop and see where it happened.

They can also see how they compare their scores to others’ in their “ecosystem,” such as co-workers or family members. “It’s more of a Fitbit, Weight Watchers approach. We encourage you through gamification (and) shamification,” Stokes said.

The FICO driving score will be released for employers next month and to consumers (primarily for novice drivers) in the first quarter of next year. The cost is $10 per month.

Over the next six to 12 months, FICO will incorporate data eDriving gets from its corporate fleet customers regarding collisions and traffic tickets so that the score accurately predicts a driver’s risk of a road incident or claim. This would be a critical next step in getting the driving score approved for insurance underwriting, Stokes said.

Progressive, Allstate and Liberty Mutual are among the companies that already offer usage-based insurance, but not in California.

Customers who opt into Allstate’s Drivewise program can get discounts based on their driving habits, although they won’t be penalized for bad driving, said Allstate spokesman Justin Herndon. About 1 in 3 new Allstate customers sign up for it.

Those who participate in Progressive’s Snapshot program can earn a discount based on safe driving, but riskier driving habits “may result in a higher rate at renewal,” the company says on its website.

The National Association of Insurance Commissioners, which represents state regulators, said in a report that linking insurance premiums more closely to driver performance “allows insurers to more accurately price premiums.” It also lets people control their premiums by driving more safely and “helps insurers more accurately estimate accident damages and reduce fraud by enabling them to analyze the driving data (such as hard braking, speed, and time) during an accident.”

But it also “has raised privacy concerns,” the report said. As a result, some states require disclosure of tracking practices and some insurers limit what data they collect.

Birny Birnbaum, director of the consumer group Center for Economic Justice, said usage-based insurance “has tremendous potential to promote loss prevention” and give people more power over their premiums. But also raises troubling issues. “If you are in an accident, the telematics data can be useful to demonstrate whether you are or are not at fault. If the insurance company uses it when its benefits them but not when it benefits you,” it’s unfair, she said.

“There is no requirement that they use the data symmetrically,” Birnbaum said. “And there is no requirement that they don’t sell your telematics data to marketers.”

Allstate does not use telematics to determine who was at fault in an accident and will only provide data to outsiders under court order, which rarely happens, Herndon said.

Progressive’s privacy policy says it will not use Snapshot data to resolve claims without getting the customer’s permission and won’t disclose it to third parties “unless it’s necessary or appropriate to service your insurance policy, detect or prevent fraud, perform research, or comply with the law.”

Richard Holober, executive director of the Consumer Federation of California, considers the use of telematics in insurance “a phenomenal violation of our privacy. They know every place you go, every move you make, every time you hit the brakes.”

And there are “potential discriminatory problems,” Holober said. For example, if data shows that people driving at night have more accidents, it could penalize janitors who work the night shift.

Birnbaum said regulators “by and large haven’t set up guardrails” to protect consumers and provide transparency about what goes into their rating models. Any time they try, “the companies say you are going to stifle innovation.”